Overview

This complete guide explains how to create an ATS-friendly sample resume for bank jobs in 2026. It covers resume structure, key banking skills, professional summaries, job responsibility examples, formatting rules, and common mistakes to avoid. Ideal for fresh graduates and experienced banking professionals seeking recruiter-ready resumes.

The banking sector continues to evolve rapidly in 2026 with growing emphasis on compliance standards, customer experience, digital workflows, and risk management. As competition increases, recruiters rely heavily on modern resumes screened by Applicant Tracking Systems (ATS) to shortlist candidates. Creating a professional Sample Resume for Bank Jobs is no longer optional; it is essential for standing out at the first stage of hiring.

Banks now seek resumes that demonstrate both technical competence and service-focused communication skills. Clean formatting, keyword optimization, and structured job responsibility sections are key success factors. This guide shares a complete, ATS-friendly approach to building your banking resume from essential sections to skill examples, job descriptions, formatting rules, and common mistakes to avoid all specifically updated for banking roles in 2026.

Key Points

Bank resumes in 2026 must be ATS-friendly

Clean formatting improves screening success

Highlight banking, compliance, and customer service skills

Use action verbs for job responsibilities

Include digital banking, CRM, KYC/AML experience

Entry-level resumes should emphasize skills, not titles

Avoid graphics, tables, and complex layouts

Measurable achievements increase shortlist chances

What Makes a Strong Bank Resume?

A strong Sample Resume for Bank Jobs follows a clean, professional structure that allows hiring managers and Applicant Tracking Systems (ATS) to quickly identify your qualifications, skills, and suitability for banking roles. Because most banks screen resumes digitally before human review, your resume must be both visually organized and keyword-optimized to pass initial filtering stages successfully.

An effective banking resume includes the following essential sections:

Contact Information:

This section should appear at the top of your resume and include your full name, current location, professional email address, phone number, and LinkedIn profile. Clear contact details allow recruiters to reach you easily and verify your professional online presence.

Professional Summary:

A brief 3-to-4-line summary introduces your experience level, career objectives, and primary strengths. This overview should reflect core banking competencies such as customer service, financial operations, or compliance knowledge while aligning with the job description keywords.

Skills Section:

List both technical and soft skills relevant to banking. This includes customer relationship management abilities, cash handling expertise, compliance procedures, CRM platforms, digital transaction tools, and communication skills. Structuring skills clearly improves ATS keyword matching.

Professional Experience:

This is the most heavily reviewed section of your resume. It should include structured bullet points describing job responsibilities alongside measurable achievements that demonstrate performance impact wherever possible.

Education:

Include degree details, universities, graduation years, and any relevant certifications related to finance, banking, or regulatory training programs.

Optional Additions:

Internships, volunteer finance work, or industry training can be added to strengthen entry-level profiles and demonstrate practical exposure.

Together, these sections create an ATS-ready resume that showcases your expertise clearly while appealing to recruiters seeking capable banking professionals.

Also Read : How to List Your Education on a Resume (Complete 2026 Guide)

ATS-Friendly Formatting Rules

To ensure your Sample Resume for Bank Jobs passes Applicant Tracking System (ATS) screening, proper formatting is essential. ATS software reads resumes using automated parsers that struggle with complex layouts, so simplicity is key. Avoid using graphics, icons, tables, charts, or multi-column designs, as these elements often disrupt text recognition and cause content to be misread or skipped entirely. Stick to standard fonts such as Arial, Calibri, or Times New Roman to maintain compatibility with all ATS platforms.

Structure your resume using clean headings and simple bullet points that clearly separate sections like skills, experience, and education. This improves readability for both automated scanning tools and recruiters reviewing your resume afterward.

Always submit files in the format requested by the employer typically Word (.docx) or PDF with Word documents being the safest for data parsing unless PDFs are specifically allowed.

Consistency is also vital. Maintain the same layout style, spacing, and formatting throughout all sections to avoid confusion and data misclassification during scanning. A clean, structured presentation ensures your resume passes ATS filtering smoothly and moves forward to recruiter evaluation without unnecessary barriers.

Also Read : Words to Describe Yourself on a Resume (2026 ATS-Optimized Examples)

Key Banking Skills Employers Want in 2026

In 2026, banks are seeking candidates who combine strong financial knowledge with digital and customer-facing competencies. A competitive Sample Resume for Bank Jobs must reflect this blend of traditional banking expertise and modern technical ability. Employers now prioritize professionals who can deliver excellent service while navigating increasingly automated systems and strict regulatory frameworks.

Customer Relationship Skills remain essential for front-facing and support roles. Candidates should demonstrate experience in client onboarding management, handling new account setups accurately while ensuring regulatory compliance. Account servicing and relationship building skills show the ability to maintain long-term client connections, resolve concerns, and encourage service loyalty. Effective query resolution and service escalation illustrate communication strength and problem-solving ability under pressure.

Financial Operations Skills showcase core banking competence. These include transaction processing for deposits, withdrawals, and fund transfers, along with high cash-handling accuracy to ensure balanced records. Employers value knowledge of loan documentation procedures and account reconciliation, reflecting attention to financial detail and audit readiness.

Compliance & Regulatory Knowledge is increasingly critical. Banks expect familiarity with KYC (Know Your Customer) verification, proper handling of AML (Anti-Money Laundering) documentation, structured audit preparation processes, and accurate record maintenance and verification to support regulatory requirements.

Technology & CRM Proficiency helps candidates stand out. Skills using CRM platforms such as Salesforce, Zoho, or internal banking systems demonstrate readiness for customer data management. Experience with digital transaction systems and online customer ticket management tools further highlights operational efficiency.

Risk Awareness skills also play an important role. Employers seek professionals with basic fraud detection knowledge, the ability to support credit eligibility assessments, and experience reviewing loan documentation for compliance accuracy.

Banks prioritize resumes that show mastery of these blended skill sets, signaling candidates who can operate confidently in today’s digitally advanced, regulation-heavy banking environments.

Also Read : New Teacher Resume With No Experience: Step-by-Step Guide & Examples

Resume Summary Examples for Bank Jobs

A professional summary is your first impression. Here are ATS-aligned samples for different experience levels.

Entry-Level Banking Resume Summary

Motivated business graduate seeking entry-level banking position with strong customer service skills, financial documentation knowledge, and digital transaction support experience. Adept at learning compliance procedures and maintaining transactional accuracy.

Experienced Banking Resume Summary

Customer relationship banking professional with 5+ years of experience in branch operations, financial compliance, loan documentation, and CRM-based account management. Proven ability to handle high-volume transactions while delivering excellent client support.

Skills Section Examples

Your skills section must be clean, categorized, and keyword-aligned.

Soft Skills

- Customer communication

- Attention to detail

- Team collaboration

- Problem resolution

- Time management

Technical & Banking Skills

- Account processing systems

- Cash reconciliation

- KYC/AML compliance workflows

- Loan documentation tracking

- Digital banking portals

Software Tools

- Microsoft Excel

- CRM banking systems

- Document management software

- Online reporting platforms

Also Read : Technical Skills for a Resume in 2026: What Employers Want

Job Responsibilities Examples for Banking Roles

Here are direct copy-ready examples for the most common banking positions in 2026.

1. Bank Teller Responsibilities

- Processed daily cash transactions including deposits, withdrawals, and transfers

- Verified identity documentation under KYC procedures

- Balanced cash drawers and generated end-of-day reports

- Provided frontline service for account inquiries

2. Customer Relationship Officer

- Managed customer account onboarding and profile updates using CRM tools

- Resolved service tickets and maintained satisfaction benchmarks

- Educated clients on digital banking services

3. Credit Officer

- Assisted with credit eligibility assessments

- Verified loan documentation and compliance records

- Evaluated borrower risk profiles using financial data

- Coordinated approvals between lending departments

4. Branch Operations Assistant

- Supported daily branch transactions and administrative documentation

- Scheduled internal financial audits

- Maintained record security and cash flow monitoring

- Implemented compliance procedures across operations teams

5. Fresh Graduate Banking Trainee

- Assisted in transaction processing and customer documentation

- Learned regulatory compliance workflows

- Prepared file records and operational reports

- Supported experienced bankers with daily tasks

Also Read : Personal Details in Resume with Examples in 2026

Education Section Guidelines

Your education must be clearly presented:

Degree Example

Bachelor of Commerce (B.Com)

University of Karachi — 2025

Financial Certifications (Optional)

- Certified Banking Associate Program (CBAP)

- AML Compliance Training Certificate

- Customer Relationship Management Certification

Certifications improve credibility and recruiter trust.

Also Read : How to Put References on a Resume (2026 Guide)

ATS Optimization Tips for Bank Resumes

Since most banks rely on ATS software, your Sample Resume for Bank Jobs must be optimized properly.

Keyword Alignment

Use keywords from job postings naturally such as:

- “transaction processing”

- “customer account management”

- “credit assessment”

- “loan documentation”

- “CRM platform”

Formatting Compliance

- Avoid PDFs with embedded graphics

- No italicized headers or two-column layouts

- Standard section headings only

Active Phrasing

Replace passive lines like:

Responsible for assisting customers

With:

Assisted customers in resolving account inquiries and transaction processing

Also Read : Best Resume Action Verbs for 2026 (ATS-Optimized Guide)

Common Resume Mistakes to Avoid

Avoid these frequent pitfalls:

Overfilling resumes with irrelevant experience

Listing outdated technology skills

Copy-pasted generic descriptions

Missing measurable achievements

Poor or cluttered formatting

A winning Sample Resume for Bank Jobs highlights role relevance not volume.

Conclusion

Building a successful Sample Resume for Bank Jobs in 2026 requires more than listing education and job history it demands strategic storytelling combined with ATS optimization. By structuring your resume with clean formatting, aligned keywords, clear responsibilities, and strong professional summaries, you maximize recruiter confidence and ATS ranking simultaneously.

Modern career platforms like Sound CV simplify this entire process. Sound CV generates ATS-friendly resume templates, scores keyword alignment automatically, and assists candidates in writing professional summaries and responsibility bullet points tailored specifically to banking job postings. Just as businesses manage digital branding strategies, Sound CV empowers individuals to brand their careers through optimized presentation and professional storytelling.

In highly competitive banking recruitment environments, a resume built with clarity, structure, and discoverability principles becomes your strongest career asset and Sound CV makes achieving that easier than ever.

FAQs

Frequently asked questions about this topic

Related Blogs

Explore more insights and guides you might like.

SEO Executive Resume Templates & Tips for Every Experience Level (ATS Guide)

Create a professional SEO Executive resume with templates, ATS tips, key skills, and proven strategies for every experience level.

Management Consultant Resume Guide (Format, Examples & ATS Tips)

Create a powerful management consultant resume with the right format, ATS keywords, and proven templates to impress top consulting recruiters.

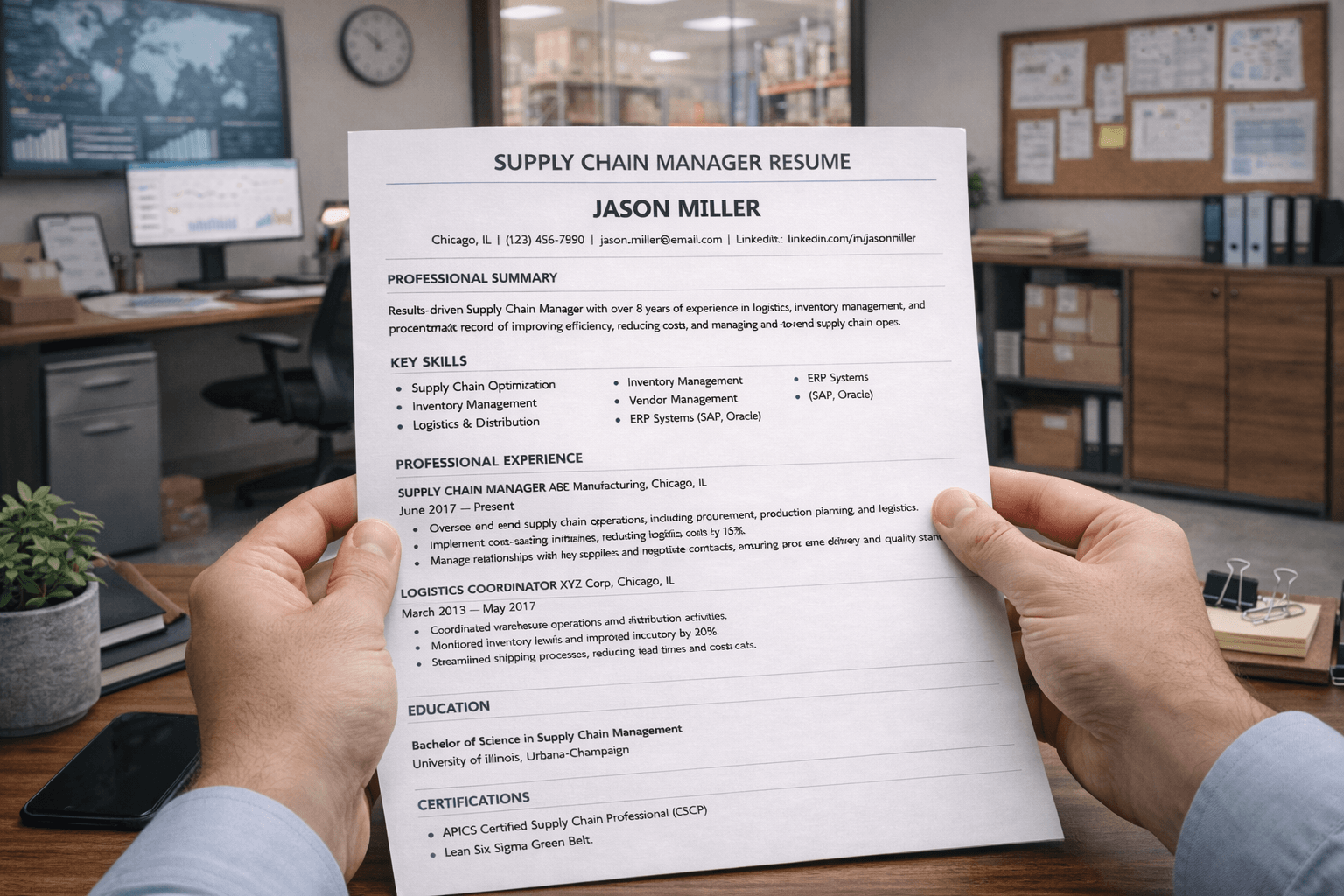

Supply Chain Manager Resume Guide: Format, Skills & ATS Tips

Create a strong supply chain manager resume with the right format, skills, metrics, and ATS optimization to impress recruiters.